Two recent articles make it clear that contactless payment methods are here to stay. In fact, they’re likely going to be the primary way people buy almost everything in the very near future. According to Credit Union Times and Digital Transactions, large investments in digital payment technology and contactless cards will streamline retail sales and other transactions starting in 2020.

Big investments are set to change the way people do business.

PCSU, an organization that provides payment services (like credit/debit cards) to credit unions, is planning to invest $100 million in payment infrastructure updates and cloud-based services over the next three years. The firm has already delivered more than 500,000 contactless payment cards to credit union members in 2019. Most of these were issued to members whose traditional cards had expired. With plans to issue another 3 million cards in 2020, it’s clear that credit unions see tap-and-go as the future of credit and debit card payments.

Why does PCSU feel so confident about contactless payment cards?

In 2018, PCSU began a survey of credit union members to find out how they like to pay. This year, the company repeated the study and came away with some interesting data. The main factors that influence consumers’ payment method decisions are convenience and usability. In other words, people want to pay in the easiest and fastest way they can. In fact, convenience proved to be a higher priority for consumers than security.

How could consumers place convenience above security?

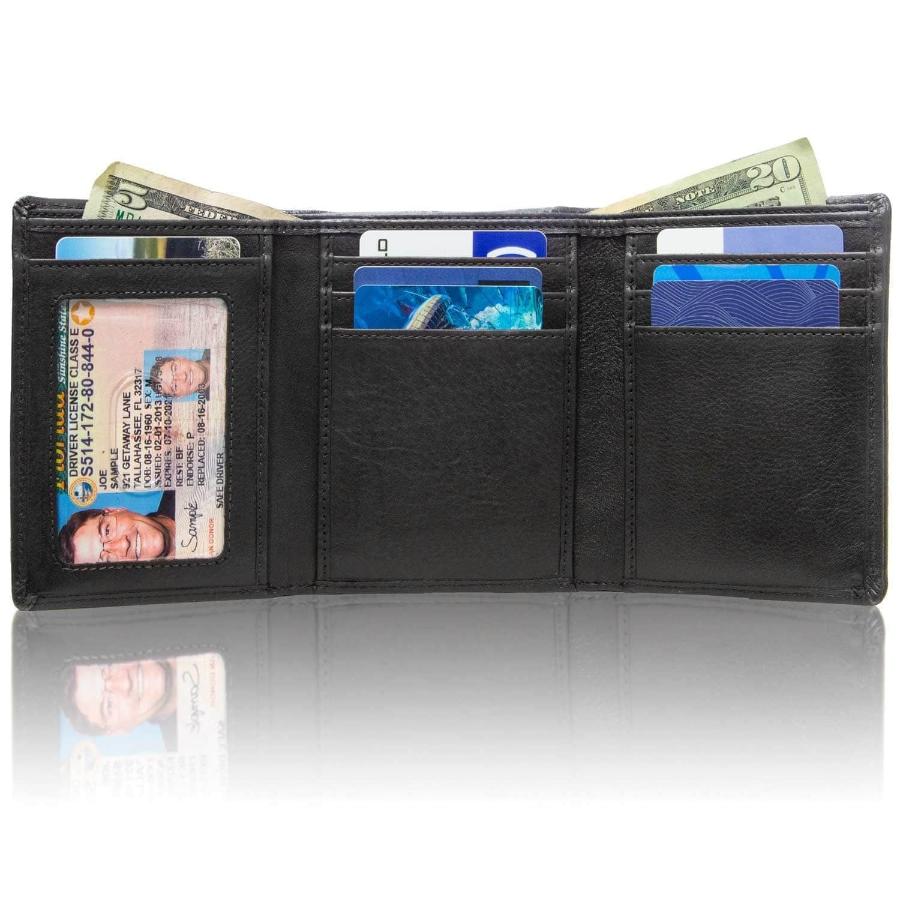

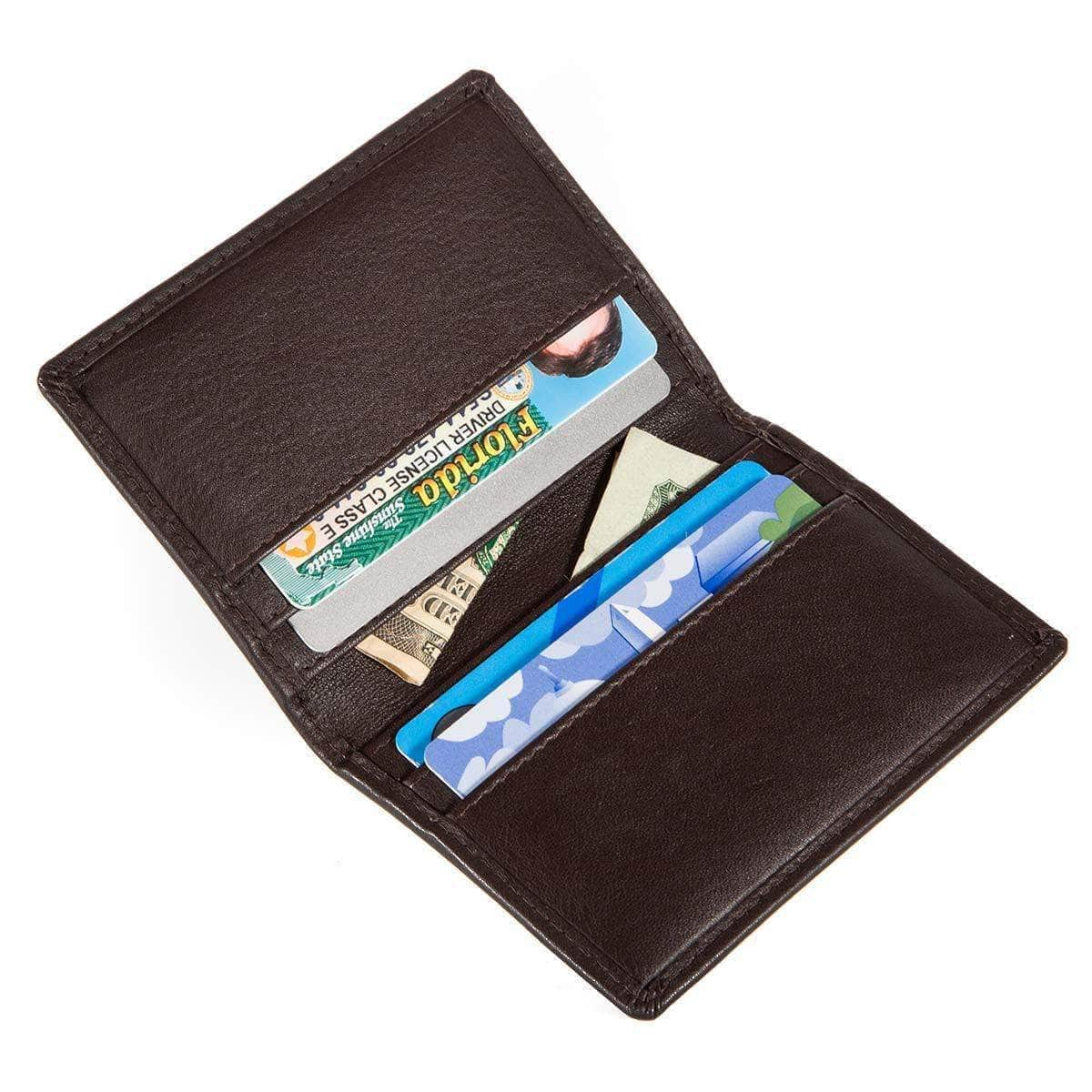

Many buyers probably don’t realize that contactless payment cards are vulnerable to digital theft, also known as skimming or digital pickpocketing. As this type of payment becomes more common, awareness will need to increase to keep cardholders safe from such threats. Fortunately, it’s easy to thwart thieves with a quality RFID-blocking wallet or purse. Not all brands marketing RFID wallets provide adequate protection. Consumers simply need to know that the threat exists and how to combat it.

Paying with mobile devices is hot, but buyers should beware that these devices are just as vulnerable to electronic pickpocketing as contactless cards.

As demonstrated by ID stronghold in multiple news interviews, mobile wallets, or smartphone payment apps, can also fall prey to digital skimmers and hackers. According to PCSU’s survey, these apps are quite popular among respondents. Millennials and younger consumers use them frequently and often prefer to pay with their phones. Wearable devices, such as smartwatches, can be tethered to phones and used at contactless payment terminals. These are also favored among younger consumers. For owners of these devices, small RFID-blocking bags are good choices for safeguarding money and personal information.

What does this news mean for buyers and sellers?

If you’re a merchant of any kind, the widespread use of contactless payment cards has clear implications. Many consumers already use RFID-enabled cards and smartphones to purchase goods and services. In a short time, those who are currently lagging behind will catch up and start using contactless payment methods too. Retailers and service providers will need to accommodate the growing number of buyers who want tap-and-go payment.

As a consumer, you’ll likely be able to pay at all of your favorite brick-and-mortar stores with your contactless card or phone. Someday soon, even mom-and-pop shops will probably be equipped to accept payments via RFID credit cards. There’s a real possibility that increased use of contactless payment will encourage the growth of digital skimming as well. Now is a good time to think about protecting your money and identification with an RFID blocking wallet from ID Stronghold.